Tired of watching your super underperform while property prices rise?

Tired of watching your super underperform while property prices rise?

We Help Smart Investors Turn Their Underperforming Super Into a High-Performing Investment Property (Even When Your Personal Borrowing Has Hit the Wall)

Apply for Your Free ‘SMSF Clarity Call’ to Learn If SMSF Is Right for You, Exactly What Your Super Can Borrow, and How to Move Forward With Confidence

Completely free to explore.

No strings attached.

Every Day You Wait, You’re Bleeding Profits and Losing Deals

You’ve found the perfect site.

The numbers stack up.

But then—the funding stalls.

Banks drown you in red tape, private lenders slap on sky-high interest rates, and your project? Dead in the water.

Each delay sends costs spiralling—holding expenses, rising interest rates, and supplier prices creeping up by the day.

The longer you wait, the thinner your margins get, turning a once-profitable project into a financial headache.

Deadlines loom, budgets blow out, and suddenly you're scrambling to plug gaps just to keep things afloat.

While you’re battling delays, your competitors are closing deals, breaking ground, and cashing in.

The sites you scouted? Gone.

The profits you planned for? In someone else’s pocket.

Months of planning, negotiations, and site analysis? Wasted, all because the funding didn’t come through.

But it doesn’t have to be this way.

Hi, I’m Michael, Director at Balcombe Financial.

We help property developers secure the funding they need to acquire, build, and complete high-return developments—without the usual financial roadblocks.

Whether you’re working on a small subdivision, a large-scale apartment complex, or a commercial development, we tailor solutions that move your projects forward fast and with maximum flexibility.

With access to over 40+ bank, non-bank, and private lending solutions, we unlock flexible terms, maximise your loan amounts, and keep your projects moving from acquisition to completion.

“Michael found me a loan that others said wasn't possible”

- John Zambelis, Victoria

“Michael’s professional services were key in securing the finance on our commercial development in a tight timeframe”

- Casey Landman, Victoria

No more missed deadlines. No more compromises.

Just streamlined, stress-free financing that lets you scale your portfolio, maximise your profits, and build long-term wealth.

Ready to secure the capital you need—fast and stress-free?

Apply for your free 'Get Funded' Consultation with Victoria’s top property development finance experts.

We’ll never leave it up to algorithms or call centre staff to future growth of your projects.

In this complimentary 20-minute session, we’ll help you:

1

GET A FINANCING STRUCTURE BUILT FOR YOUR PROJECT:

Discover the exact funding solution for your development goals—no more ‘one-size fits all’ loans that don’t fit your needs.

2

SECURE FAST APPROVALS WITHOUT THE USUAL ROADBLOCKS: We’ll map out how to cut through lender red tape and get your project moving—before delays eat into your profits.

3

FUND YOUR PROJECT WITH LESS OF YOUR MONEY: We’ll show you how to secure financing with minimal personal capital and more lender flexibility than you thought possible.

4

WALK AWAY WITH A CLEAR, ACTIONABLE FUNDING STRATEGY: Get a clear, actionable financing strategy tailored to your development—no fluff, no wasted time, just the exact next steps to get funded fast.

Spots are limited, and projects are moving fast.

Don’t let another opportunity slip through your fingers— apply for your free ‘Get Funded’ Strategy Session today and secure the financing you need before it’s too late.

To your success,

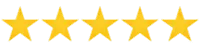

Discover How To Turn Your Underperforming Super Into A Property That Pays You Monthly

For successful investors like you…

There inevitably comes a point where banks say "no more" despite your solid income and built-up equity.

It's the frustrating reality of property investing – the better you get at it, the faster you hit your borrowing limit.

At the same time, your super balance crawls forward at a snail's pace.

The average Australian super fund delivers a real return of just 5.4% per year - barely keeping ahead of inflation.

That's often hundreds of thousands of dollars sitting in investments you didn't choose and have very limited control over, growing far too slowly to deliver the retirement you've worked for.

I've spent the last decade helping investors like you break through this common roadblock.

The solution is remarkably simple yet powerful: using your super to buy investment property through an SMSF.

Hi, I'm Arnab from Cinch Loans.

We help smart Aussie investors turn their underperforming super into a high-performing investment property.

Hi, I'm Arnab from Cinch Loans.

We help smart Aussie investors turn their underperforming super into a high-performing investment property.

While most brokers avoid SMSF lending due to its complexity, we've built our entire business around our 'Super Property Pathway'.

Our proven 5-step system that has guided over 500 clients from initial strategy to successful property settlement.

Our clients' success stories speak for themselves:

David & Emma's $180K super now funds a growing property asset,

putting them on track to retire 5 years earlier with an investment they control.

Michael transformed his $155K super into his first SMSF property,

building a legacy asset growing twice as fast as his previous super.

Jennifer & Robert used $220K combined super to add another property when their borrowing capacity was maxed, accelerating their path to financial independence.

That's why I'd like to personally invite you for a free 'SMSF Clarity Call'.

On this call:

1

We'll map your exact super borrowing power—even with maxed-out personal lending

2

You'll learn if SMSF property investing suits your situation before investing time or money

3

We'll explain how to structure your setup the right way to avoid double stamp duty, compliance headaches, and expensive mistakes

4

You'll get a clear path forward, whether you work with us or not

The call is completely free, with no obligation.

It's simply our way of helping you determine if this powerful strategy is right for your situation.

Don't let artificial lending constraints keep you from building the property portfolio and financial future you deserve.

Your super could be the missing piece in your wealth-building strategy.

To your success,

Completely free to explore.

No strings attached.

Don’t Just Take Our Word for It—See What Our Clients Say

My wife and I are repeat customers, having already 2 properties financed through Cinch Loans, and currently processing loans for 2 more investment properties... It's refreshing to have someone look after us and proactively reach out to help save us money.

- Arthur W.

Arnab Baral expertly navigated the complexities of my SMSF commercial loan refinance... His deep understanding of SMSF lending, coupled with exceptional professionalism, secured a competitive loan tailored to my financial goals.

- Nandakumar A.

I recently purchased a property through Cinch Loans... Arnab and Rahul were there every step of the way, providing guidance and reassurance... Navigating the loan process with a newly established SMSF in a different state was daunting, but their expertise made it manageable. Their dedication and commitment truly made all the difference.

- Gourav A.

Arnab and Rahul at Cinch Loans were fantastic for us when we had to refinance our SMSF property. They were very clear on what documentation they needed, and helped us navigate a series of unexpected hurdles. Our new rate is MUCH better than our old rate, and we're much happier with our new lender. Will happily recommend and use again.

- Joe T.

My situation was unique from the start, and Suvidh helped me through the process. His team was professional, and despite the uniqueness of my mortgage requirements, they guided me through the requirements I needed to meet and got me a formal approval within a few weeks.

- Michael Z.

Cinch were really supportive from day 1. They went above and beyond to provide us with all the information we needed at every stage of our home build planning process. They have also been extremely understanding and patient in the process as we did not have any prior knowledge regarding the SMSF process or financial aspects of it all.

- David P.

Completely free to explore.

No strings attached.

Break Through Your Borrowing Ceiling & Build True Wealth in 5 Easy Steps

The Super Property Pathway™ is our proven system that makes it simple to transform your underperforming super into a property portfolio that builds real wealth and security.

SMSF Clarity Call:

A free consultation to determine if SMSF property is viable for you, calculate exactly how much your super could borrow, and create a tailored roadmap that helps you avoid costly mistakes.

SMSF Clarity Call:

A free consultation to determine if SMSF property is viable for you, calculate exactly how much your super could borrow, and create a tailored roadmap that helps you avoid costly mistakes.

Smart Fact Find & Doc Collection:

A streamlined low-doc process to gather only essential information and paperwork, with human guidance every step of the way.

Smart Fact Find & Doc Collection:

A streamlined low-doc process to gather only essential information and paperwork, with human guidance every step of the way.

SMSF Setup (If Needed):

Don't have an SMSF? We'll connect you with our trusted accountant or work with your own to ensure everything's set up correctly.

SMSF Setup (If Needed):

Don't have an SMSF? We'll connect you with our trusted accountant or work with your own to ensure everything's set up correctly.

Formal Pre-Approval:

Get a lender-backed approval that shows exactly what you can borrow, not just rough estimates… before you start property hunting.

Formal Pre-Approval:

Get a lender-backed approval that shows exactly what you can borrow, not just rough estimates… before you start property hunting.

Property Purchase:

Buy with confidence knowing we're by your side through settlement, without surprises or stress.

Property Purchase:

Buy with confidence knowing we're by your side through settlement, without surprises or stress.

Completely free to explore.

No strings attached.

Recent Client Wins Helping Aussie Investors Like You

The Williams Family Added Multiple Properties To Their Portfolio After Hitting Their Lending Ceiling

The Williams family wanted to rapidly grow their SMSF's property holdings with several acquisitions. Our team coordinated financing for multiple properties at once, ensuring full compliance while securing a competitive 6.69% rate.

Emma & James Expanded Their Property Portfolio Using Super When Banks Said No

Emma and James wanted to diversify their SMSF investments with a residential property. We secured a tailored loan with a favourable 70% LVR on a 30-year term, allowing them to acquire exactly the property they wanted.

David Built A Commercial Property Empire Using His Super To Fund Early Retirement

David was looking to enhance his SMSF's asset portfolio with a commercial property investment. We structured a compliant 6.75% loan that aligned perfectly with his investment goals and SMSF regulations.

Mark & Lisa Created A Holiday Rental Cash Machine Using Their Underperforming Super

Mark and Lisa wanted to purchase a holiday rental property within their SMSF. We structured a loan at 6.55% that met all borrowing criteria, adding a strong income-generating asset to their retirement portfolio.

Saved $32,000 in Interest by Refinancing Their SMSF Commercial Property

The Johnsons were stuck with a legacy SMSF loan at 10.19% interest. We refinanced their limited recourse borrowing arrangement to 6.39%, freeing up significant funds for portfolio diversification.

Robert Transformed His Underperforming Super Into A Prime Office Investment

Robert needed structured financing for an office space investment within his SMSF. We arranged a loan that met all SMSF borrowing requirements at 6.80%, facilitating a smooth purchase that enhanced his portfolio diversity.

First-Time SMSF Investor Successfully Purchases Interstate Investment Property

Sarah and Michael navigated the complex process of investing through their newly established SMSF in a different state. With our expert guidance, they secured a competitive 6.59% loan with 70% LVR on a 30-year term.

The Thompsons Diversified Their Super Into Industrial Property For Superior Returns

The Thompsons were looking to add industrial property to their SMSF investments. We secured financing aligned with their SMSF investment strategy at 6.70%, enabling them to enhance their asset base with this specialised property type.

Jennifer Achieved Above-Market Returns Using Her Super For Rooming House Investment

Jennifer faced challenges securing finance for a licensed rooming house offering strong rental yield. We structured the loan through a specialised lender at 6.90%, resulting in cash flow that exceeded her projections.

Paul Secured Government-Backed Returns Through Strategic SMSF Property Investment

Paul sought financing for an NDIS SDA-compliant property with specialised modifications. We arranged an SMSF loan through a specialist lender at 6.85%, securing a property with government-backed lease generating exceptional returns.

Apartment Investment Diversifies SMSF Portfolio with 70% LVR

The Wilsons wanted to invest in an apartment property through their SMSF. We secured a tailored loan at 6.60% with favourable terms, allowing them to successfully diversify their investment portfolio.

High-Value Retail Property Successfully Added to SMSF Investment Portfolio

Steven was looking to acquire a retail property as part of his SMSF's diversification strategy. We arranged financing that fully complied with all regulations at 6.68%, successfully adding this valuable asset to his investment mix.

Completely free to explore.

No strings attached.

⚠️ Tired of watching your super underperform while property prices rise? ⚠️

⚠️ Tired of watching your super underperform while property prices rise?⚠️

Apply for Your Free ‘SMSF Clarity Call’ and Discover How to Use Your Super to Buy Your Next Investment Property

1

Find out if SMSF property is actually viable for you — before wasting time, money or energy

2

Understand exactly how much your super could borrow — even if you’ve maxed out your personal lending

3

Learn how to structure your setup the right way to avoid double stamp duty, lender knock-backs and compliance headaches

4

Walk away with a step-by-step path to move forward safely & confidently (with or without us)

Completely free to explore.

No strings attached.

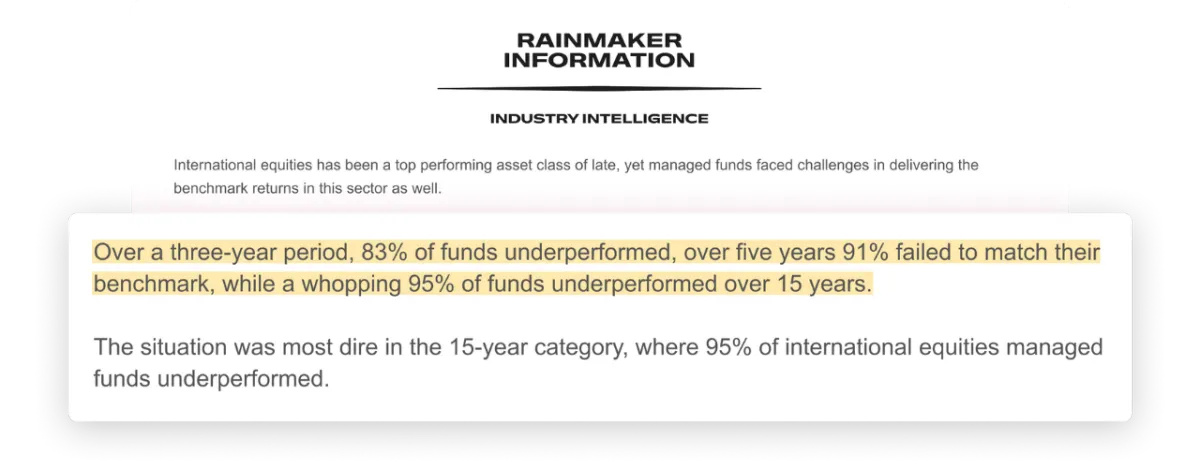

⚠️ 95% of Super Funds Are Failing Their Members ⚠️

Super funds might promise you financial security, but the data tells a much more concerning story.

From consistently underperforming investments to excessive fees, everyday Australians' retirement funds aren't working as hard as they should.

And that's before considering the high administration fees, tax on contributions and earnings, plus the various hidden investment charges eating away at your balance.

That's precisely why so many Australians worry they won't have enough to retire comfortably.

1. Widespread Underperformance:

Over 95% of managed super funds underperformed their benchmarks over a 15-year period. This means the vast majority of Australians have retirement savings growing significantly slower than they could be.

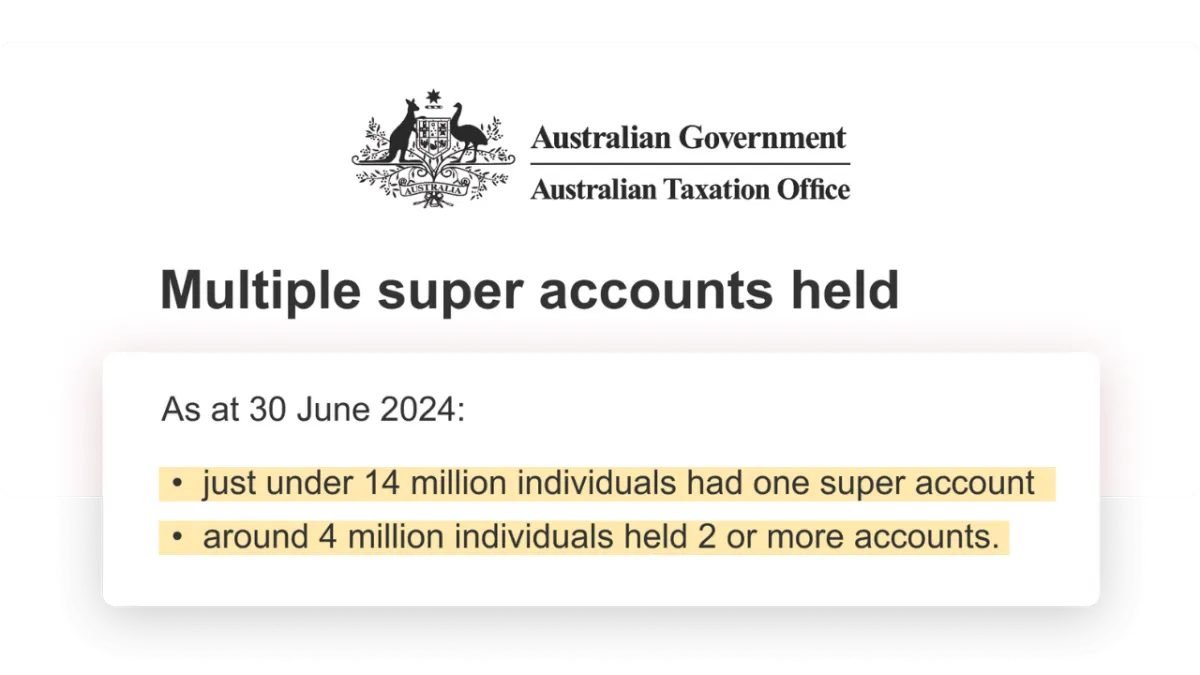

2. Multiple Super Accounts Draining Your Wealth:

As of June 2024, approximately 4 million Australians had 2 or more super accounts. Each additional account means more unnecessary fees and charges steadily eroding your retirement savings year after year.

3. Escalating Fee Structures:

Many super funds charge substantial and often hidden fees. As your super balance grows, so do these fees – significantly reducing the amount you'll have available to live on in retirement.

5 Reasons Financially-Savvy Australians Choose Cinch for SMSF Property Loans

60+ Industry Awards for Excellence

You wouldn’t go to a GP for heart surgery… and you shouldn’t trust your super to just any broker.

There’s a reason the industry keeps handing us awards. We make the process simple, stress free, and wildly effective.

60+ Industry Awards

for Excellence

You wouldn’t go to a GP for heart surgery… and you shouldn’t trust your super to just any broker.

There’s a reason the industry keeps handing us awards. We make the process simple, stress free, and wildly effective.

200+ Five-Star Reviews From Successful SMSF Investors

The reviews say it better than we ever could: fast, helpful, clear, reliable. Over 200 people have left five stars for a reason.

SMSF Lending Is Our Bread and Butter

While other brokers avoid SMSF loans like the weird uncle at the barbecue, we’ve built our whole business around it.

We know the rules, the lenders, the setup, and how to get it done without the stress.

Low-Doc, High-Support Process

Hate paperwork? So do we.

That’s why we’ve made it low-doc, low-stress, with real human help at every step of the process.

Our Help Is Free.

You Don’t Pay a Cent.

There’s no cost for our service. We don’t charge you a cent.

We get paid a commission from the lender you decide to go with, for bringing them your business.

You’re an Experienced Developer Needing More Flexible Funding

Banks slow you down with pre-sale requirements and rigid terms. We connect you with private lenders, mezzanine finance, and high-LVR solutions so you can fund more projects and scale faster.

200+ 5-Star Reviews From Successful SMSF Investors

The reviews say it better than we ever could: fast, helpful, clear, reliable.

Over 200 people have left five stars for a reason.

SMSF Lending Is Our Bread and Butter

While other brokers avoid SMSF loans like the weird uncle at the barbecue, we’ve built our whole business around it.

We know the rules, the lenders, the setup, and how to get it done without the stress.

Low-Doc, High-Support Process

Hate paperwork? So do we.

That’s why we’ve made it low-doc, low-stress, with real human help at every step of the process.

Our Help Is Free.

You Don’t Pay a Cent.

There’s no cost for our service. We don’t charge you a cent.

We get paid a commission from the lender you decide to go with, for bringing them your business.

Completely free to explore.

No strings attached.

Completely free to explore.

No strings attached.

How Smart Developers

Get Funded

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Hidden Cost or Downsides of Competitors]

[Customer Support/Service]

B

Comparison #1

Comparison #1

100% Free, No-Obligations

Got Questions?

We’ve Got the Answers

Do I need a massive super balance to get started?

Not at all. With a combined balance of $150K+ and lenders offering up to 70% LVR, you're already in a strong position to start building wealth through property in your super.

Isn't setting up an SMSF complicated and expensive?

The complexity is precisely why we created the Super Property Pathway™. We handle the technical aspects while our network of trusted specialists ensures your setup is cost-effective and 100% compliant.

Can I lose my entire super if something goes wrong?

No. SMSF property loans use limited recourse borrowing, which protects your other super assets. With our expert guidance, you can invest confidently knowing the structure is set up correctly from day one.

Why should I trust Cinch Loans over other brokers?

Unlike general brokers who avoid SMSF loans, we've built our business around them. With 60+ industry awards, 200+ five-star reviews, and a streamlined process, we're Australia's #1 specialists in SMSF property investing.

⚠️ 95% Of Super Funds Are Underperforming ⚠️

⚠️ 95% Of Super Funds

Are Underperforming ⚠️

Apply For Your Free 'SMSF Clarity Call' And Discover If Your Super Could Buy Your Next Investment Property

In just one phone call, learn if your super has enough power to buy property, how to structure it correctly, and the exact path to make it happen – with no obligation to proceed.

Completely free to explore.

No strings attached.

Our Service Will Help Decrease Burning Problem By Quantifiable Measure Or Penalty

We’re so confident in our ability to [Achieve Outcome] that we’re taking all the risk off your shoulders.

If we don’t [Specific Result Guarantee], you won’t pay a cent. No fine print, no hidden conditions – just a rock-solid guarantee to prove how committed we are to your success.

Because at [Your Business Name], we don’t just promise results. We guarantee them. If we don’t deliver, you don’t pay. It’s that simple.

100% Free, No-Obligations

Still Not Sure About Something?

Your 1st Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 2nd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 3rd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 4th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 5th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

100% Free, No-Obligations

Spots Are Filling Fast...

Claim Your Free Offer Name Today and Benefit

100% Free, No-Obligations

©2025 Cinch Loans. All rights reserved. ACN 87 629 633 423

DISCLAIMER: Your complete financial situation will need to be assessed before acceptance of any proposal or product. See here for our privacy policy. Setting up an SMSF involves certain one-off establishment costs and ongoing annual fees, which vary depending on your chosen accountant, administrator, and fund structure. These costs are separate from any lending or property purchase expenses and should be considered when assessing SMSF property investment suitability.

Cinch Loans is a trading entity for credit representative numbers 526855, 546669, 536383, 523265, 556649 authorised under Australian Credit License 384324.